Survey shows concerns among clinicians and industry

Clinical ophthalmologists have a lot on their minds, and so do the industry leaders that provide the tools they use, a new survey suggests. The findings come from a survey of 203 pre-registered attendees of the ESCRS iNovation Day meeting this past Friday.

Ophthalmologists and industry representatives both cited increased regulation and decreasing reimbursement as major concerns. Non-doctors showed an elevated concern for supply chain issues, while doctors showed slightly more concern about more economic issues—recession and inflation. Interestingly, neither doctors nor non-doctors appeared to have major concerns about COVID restrictions or resurgence.

The survey highlighted some surprising contrasts among the concerns of small companies versus larger companies. While both groups expressed ongoing concern about increased regulation, larger companies were somewhat more concerned about supply chain issues, whereas smaller companies were more concerned about finding and keeping employees than their larger counterparts.

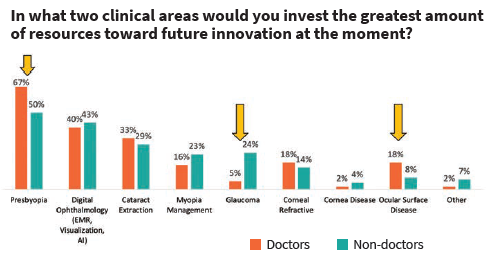

When asked, “What two areas would you invest the greatest amount of resources toward future innovation?”, clinicians put presbyopia at the top of the list, followed by digital ophthalmology (EMR, visualisation, AI) and cataract extraction. The industry response was similar, but with a greater emphasis on glaucoma.

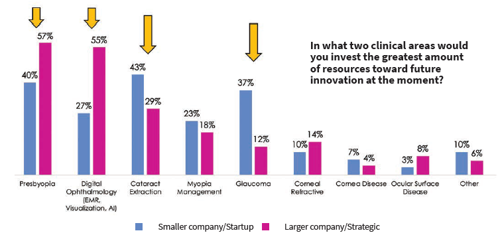

Large and small companies showed some divergence when asked the same question. Larger companies expressed a greater interest in developing presbyopia and digital ophthalmology resources, and smaller companies appeared to be more interested in developing glaucoma treatments.

Overall, smaller companies appeared to be significantly more optimistic than larger companies. Two-thirds of the smaller companies believe investment in ophthalmic innovation will either increase or significantly increase between 2022 and 2023, compared to slightly more than half of the larger companies. Some 14% of larger companies expressed concern about decreasing investment in the next year compared with 7% of the smaller companies.

The eighth annual ESCRS Clinical Trends Survey is underway. That survey asks ESCRS members key questions on current issues they face in their practices. As the name suggests, it also shows which procedures are gaining in popularity and which are fading, and why.

Latest Articles

Glaucoma Treatment Under Pressure

New techniques and technologies add to surgeons’ difficult decisions

Outside the Box, Inside the Pipeline

Researchers are tackling glaucoma diagnosis and treatment from all sides.

The EHDS Is Ready for the Green Light

If proposal is approved, Europe could see better access to, and exchange and use of, health data.

ESCRS to Release Guidelines for Cataract and Refractive Surgery

Comprehensive approach to the safest and most effective modern surgery.

Barry Fellowship Opens Up ‘Whole New Field of Thought’

The 2022 recipient combines theoretical and practical to learn new treatments.

Digitalising the OR—Experience and Perspectives

Benefits include saving time and improving outcomes.

Dynamic Measures Needed for Quality of Vision

Functional visual acuity testing and straylight metering may better reflect real-world conditions.

What Is Stopping Digital OR Adoption?

Ophthalmologists know the benefits—now it’s time to construct the right plan.

Time to Move Beyond Monofocal IOLs?

European surgeons appear hesitant to first offer other presbyopia-correcting options to patients.